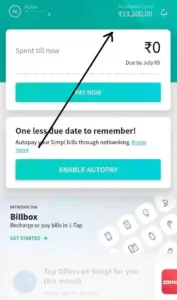

Simpl Pay Later App: Get Upto ₹25000 Free Credit Limit

Simpl Pay Later app: Signup and get a free credit limit of up to ₹25000 instantly. There is no need to upload an Aadhar card or PAN card to a credit limit on Simpl.

The best buy now pay later app as per my experience because with just one tap and payment is done! Trust me, once you’ve used this payment app, you’ll never try anything else.

From ordering groceries, food, medicines, renting a vehicle, buying travel tickets, paying your utility bills, and much more, you can use Simpl for all your daily transactions same as Amazon and Flipkart pay later.

Simpl provides a cycle of 15 days to repay your bills. This means that you can order food, groceries and more, now, and pay for it later, once in 15 days without any interest or hidden charges.

You can pay on 15,000+ merchants including Zomato, Bigbasket, Dunzo, JioMart, Tata 1mg, Netmeds, blinkit, Makemytrip, Eat Fresh and many more.

Benefits Of Pay Later

Quick & Easy Payment: Pay using Simpl with just one tap, within seconds!

Buy Now & Pay Later: It provides a cycle of 15 days to repay your bills. This means that you can order food, groceries, and more, now, and pay for it later, once in 15 days without any interest or hidden charges.

Multiple Orders, One Bill: The most preferred bnpl app as it allows you to track all your expenses on various brands, with one single consolidated bill.

Zero Fees & Interest: Say goodbye to payment charges or interest fees because Simpl provides you an opportunity to pay later without any hidden fees or additional charges. It’s even better than having any postpaid wallet!

Great Offers: Unlock exclusive cashbacks and offers on various merchants when you pay via this amazing app.

Quick Refunds: In case of order cancellation, you don’t have to wait for your refund for days!

- Minimum KYC: You can get started on Simpl with minimum paperwork and KYC formalities.

How To Get Credit Limit In Simpl App?

1) Tap on the button given below and download the Simpl pay later app.

2) Open the app and enter your mobile number and verify with the OTP.

3) In the next step enter your first name, last name, age, gender, and email id.

4) Check mark the box and tap on verify KYC button. No Aadhar/PAN is required.

5) Simpl will use your credit score from the CRIF to confirm your eligibility.

6) Once you are eligible you get up to Rs 25000 free credit limit instantly.

7) Simpl pay later payment option is available on almost every shopping site.

Example: JioMart, Zomato, MyGlamm, BigBasket, Tata 1mg, Dunzo, BlinkIt, Netmeds, etc

8) It provides a cycle of 15 days to repay your bills without any interest or hidden charges.

Simpl App FAQs

- Simple Pay Later Credit Limit:

Your spending limit is initially set by default. But once you start using Simpl, the limit is constantly updated based on a few major factors.

If you are quick and consistent in settling your dues , your credit limit increases over time. It also uses transactional SMS messages and can increase your spending limit to match your overall spending.

- Simple Pay Later Charges:

If payment is not made by the due date, you can be charged a late penalty of up to ₹250 with applicable taxes. Users are also notified multiple times via Email, SMS and other reminder notifications before the penalty is levied.

- Simple Pay Later Eligibility:

User must not be a minor as per applicable law i.e. User must be at least 18 years of age to be eligible to use service provided by the Simpl app.

It advises its users that while accessing the website, service or CC, they must follow and abide by the applicable laws.

- Simpl Pay Later Billing Cycle:

Your Simpl bill is generated twice a month. All your transactions between 1st and 15th are added into one bill, which is generated on the 15th.

All transactions made between 16th and 30th/31st are added into one bill, which is generated on the 30th/31st.

Of course, you can choose to pay for your transactions even before your bill is generated. You can do so by logging into your account via our website or app.

- Safer Than Cards & Other Modes Of Payment:

When you buy online, you have to carefully enter all your details every time. You can reduce the number of times you give out your banking data online with simpl.